Thank you @Neil_AU for joining the discussion.

I would like to discuss the baselessness of the current accusations being made against Ivy Oracle.

No Evidence For Operating Two Providers

There is no evidence provided that supports the claim that “Ivy Oracle” is running a second provider. There are no transactions or financial linkage between the providers in question; no submissions, reward or uptime patterns can be identified between the two providers, except for the price spikes.

Reviewing previously passed proposals on colluding providers, there are either admissions of collusion, or irrefutable patterns in submission. Neither of which have been presented here. The only proposal that came close was the “Sirius FTSO and HXK Oracle” proposal, in which spikes are backed up by admission of sharing said provider’s codebase and algorithm (see Reference section).

Price Spike is Not Evidence of Collusion

Price spike is the result of low quality data, not collusion. Based on the accusations, it is clear that the cause of price spikes is not well understood, and this section outlines why price spike happens, and it happens even in the absence of collusion.

Passing extremely large prices into a model results in extremely large submissions. As previously mentioned, Ivy Oracle has been using a wide range of data, including unexecuted ask and bid prices on the order book from all exchanges, high or low volume. Examples of extremely large asking prices from selected exchanges that are used by Ivy Oracle are included under the “Reference” section.

Cryptocurrency exchanges with publicly available order book data are finite. Two providers having price spikes only shows they retrieve data from the same publicly available data source. Ivy Oracle has collected order book data from a wide range of exchanges. Sharing price spikes is the natural outcome of this.

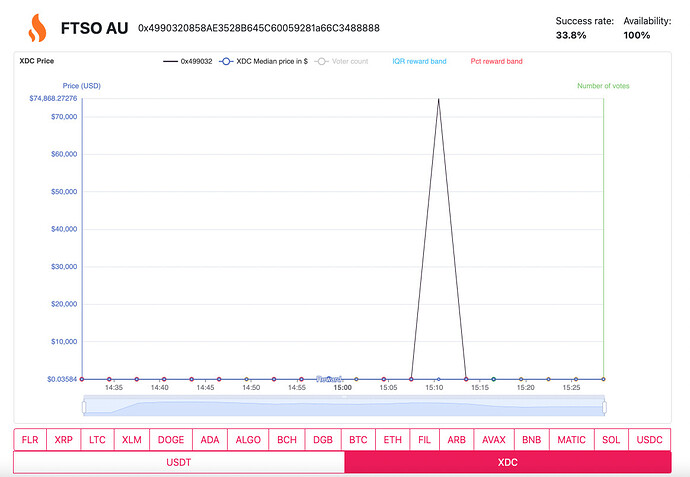

The price spike evidence provided by @AtlasTSO is incomplete, and does not represent the full picture. Since March 2024, Anon has experienced a total of 8249 price spike submissions, of which less than 0.6% are shared with Ivy Oracle. On top of that, Ivy Oracle is not the only provider that suffers from price spikes. Among them is FTSO AU (see Reference).

Edit: Per @AtlasTSO’s response, removing USDC and XDC, over a 6 months period (80,948 epochs) Anon experienced a total 212 spikes, of which less than 20% (41 spikes) are shared with Ivy Oracle, that is 0.05% of all Ivy Oracle’s submissions.

Again, Ivy Oracle is committed to providing high quality price data for the flare network, and is working tirelessly to update our code to eliminate price spike in our submissions.

Reference

Previously Passed Proposals

-

Pricing links between 3 SGB anonymous providers

- Providers in question have identical incorrect submissions and similar reward rate movements.

-

Pricing links between FLR Labs, Civil FTSO and two other anonymous providers

- Submission consistently outside reward band over significant period of time

-

Pricing links between BestFTSO and AilandFlare

- Near identical submission outside reward band over significant period of time

-

Coffee FTSO is a clone of LoveFTSO

- Submission consistently outside reward band over significant period of time

-

Sirius FTSO and HXK Oracle Same Dev and or Algorithm - #5 by Sirius

- Admission of algorithm sharing by provider

- Price spike

Large Ask Prices on Order Book

Picking from a few high volume and low volume exchange, one can easily find a large number of extremely high ask prices on their order book.

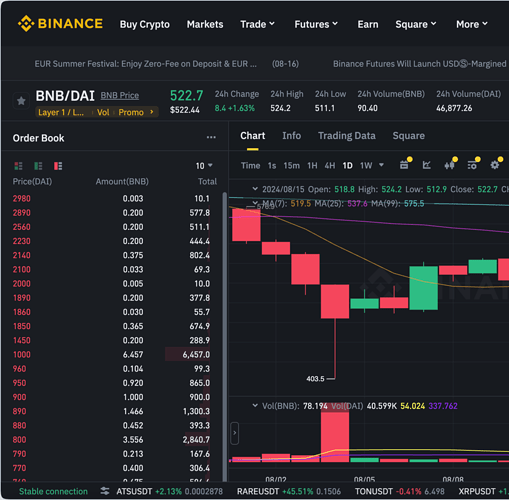

Binance BNB/DAI - ask prices up to 2K.

https://www.binance.com/en/trade/BNB_DAI

KuCoin ALGO/USDT - ask prices up to 400

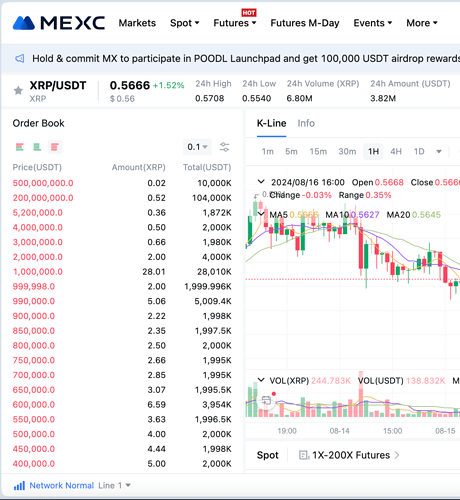

Mexc XRP/USDT - ask prices up to 500,000,000 (500M)

https://www.mexc.com/exchange/XRP_USDT

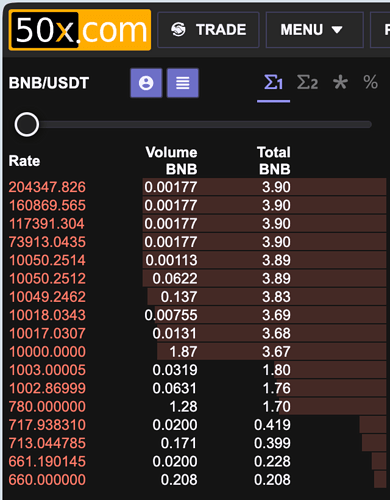

50x BNB/USDT

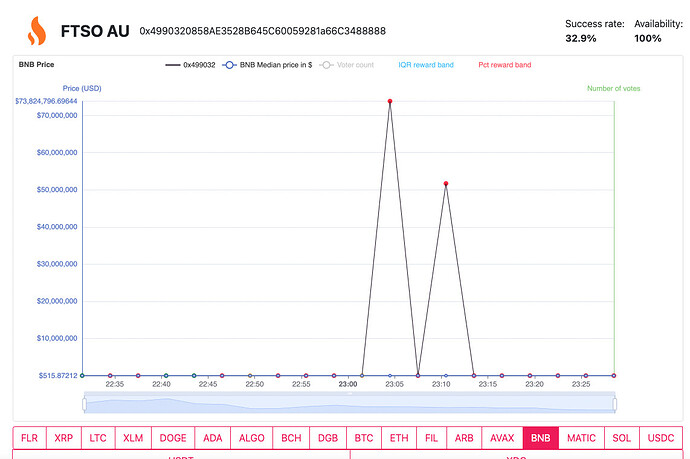

Other Provider’s Spikes

FTSO AU (0x4990320858AE3528B645C60059281a66C3488888)

BNB/USD submission - 516,82,788.15865 and 73,824,796.69644

FTSO AU (0x4990320858AE3528B645C60059281a66C3488888)

XDC/USD submission - 74,868.27276